income tax rate malaysia

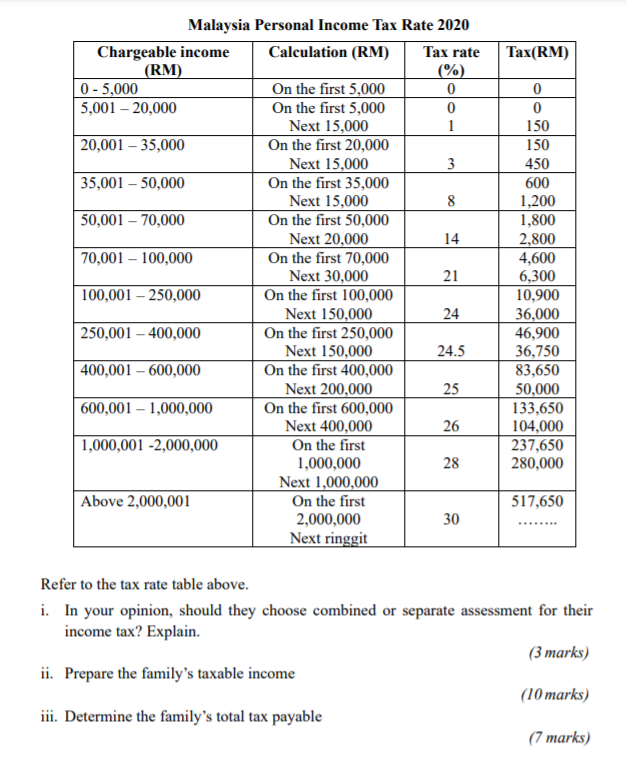

On the First 5000 Next 15000. Malaysia uses a progressive tax system which means that a taxpayers tax rate increases as the income increases.

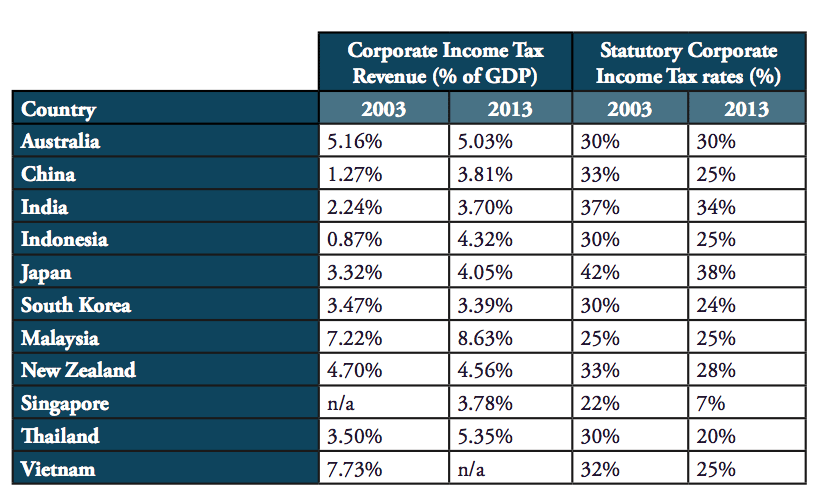

Malaysia Corporate Tax Rate 2022 Data 2023 Forecast 1997 2021 Historical Chart

Review the latest income tax rates thresholds and personal allowances in Malaysia which are used to calculate salary after tax.

. 12 rows The personal income tax rate in Malaysia is progressive and ranges from 0 to 30 depending on. To put this into context if we take the median salary of just over 2000 MYR per month⁴ a resident would pay. The KPMG member firm in Malaysia prepared a monthly summary of tax developments PDF 31 MB that includes a discussion of the following income.

Tax is imposed annually on individuals who receive income in respect of. On the First 5000. Malaysia Income Tax Rates in 2022.

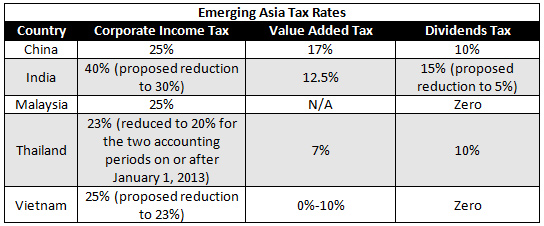

The standard corporate income tax rate in Malaysia is 24 for both resident and non-resident companies which gain income within Malaysia. However the blended tax rate is much lower for most residents. Taxable income band MYR.

13 rows Based on this amount your tax rate is 8 and the total income tax that you must pay. The Malaysia Income Tax Calculator uses income tax rates from the following tax years 2022 is simply the default year for this tax calculator. The Malaysian corporate standard income tax rate is 24 applicable to resident or non-resident companies that earn revenue inside Malaysia.

November 15 2022. Up to RM4000 for those who contribute to the Employees Provident Fund EPF including freelance and part time workers. 13 rows Personal income tax rates.

Additionally the tax relief for parents with children in kindergartens and childcare centres has been increased from RM1000 to RM2000. An effective petroleum income tax rate of 25 applies on income. A foreign individual who are employed in Malaysia has to provide hisher income data or chargeable income to the nearest LHDN branch.

Malaysia adopts a progressive income tax rate system. This notification has to be made by. Taxable income band MYR.

B Gains profit from employment. You must pay taxes if you earn RM5000 or USD1250. Taxable income band MYR.

The following rates are applicable to resident individual taxpayers. Malaysia Personal Income Tax Calculator for YA 2020. Starting from 0 the tax rate in Malaysia goes up to 30 for the highest income band.

Malaysia has a territorial tax. Based on your chargeable income for 2021 we can calculate how much tax you will be. A Gains profit from a business.

Petroleum income tax is imposed at the rate of 38 on income from petroleum operations in Malaysia. Additionally the tax rate on those earning more. 9 hours agoFinance minister Jeremy Hunt said he would freeze income tax allowances until 2028 and was lowering the threshold above which the 45 top rate of income tax is paid to.

C Dividends interest or discounts. However there are exceptions for certain. Calculations RM Rate TaxRM A.

Malaysia Income Tax Rates and Personal Allowances. This means that low-income earners are imposed with a lower tax rate. RM9000 for individuals.

China Facing Increasing Competition From Asian Neighbors On Tax Rates And Costs China Briefing News

Budget 2021 Tax Reduction For M40 Timely Yet More Could Be Done The Edge Markets

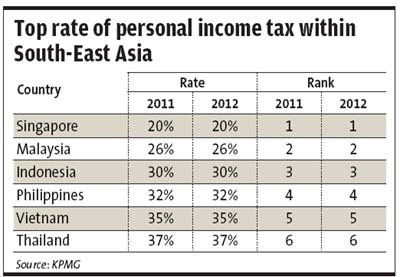

Malaysia Tax Rate Second Lowest In South East Asia The Star

Malaysian Tax Issues For Expats Activpayroll

How Do You Calculate The Foreign Tax Credit Allowed In The Unites Course Hero

7 Tips To File Malaysian Income Tax For Beginners

The Geopolitics Of Online Taxation In Asia Pacific Digitalisation Corporate Tax Base And The Role Of Governments

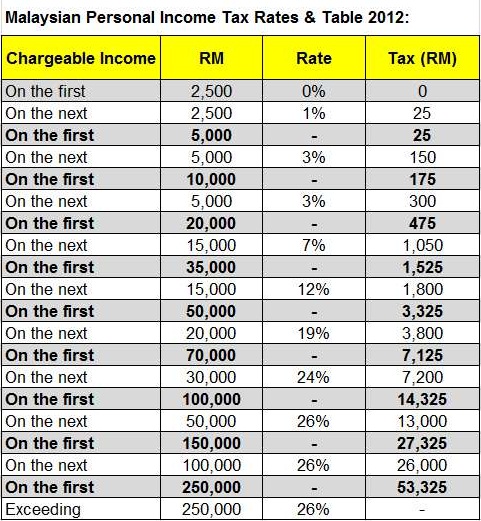

Malaysia Personal Income Tax Rates Table 2010 Tax Updates Budget Business News

Question 1 20 Marks Jafri And Hazel Are Married Chegg Com

Individual Income Tax In Malaysia For Expats Gpa

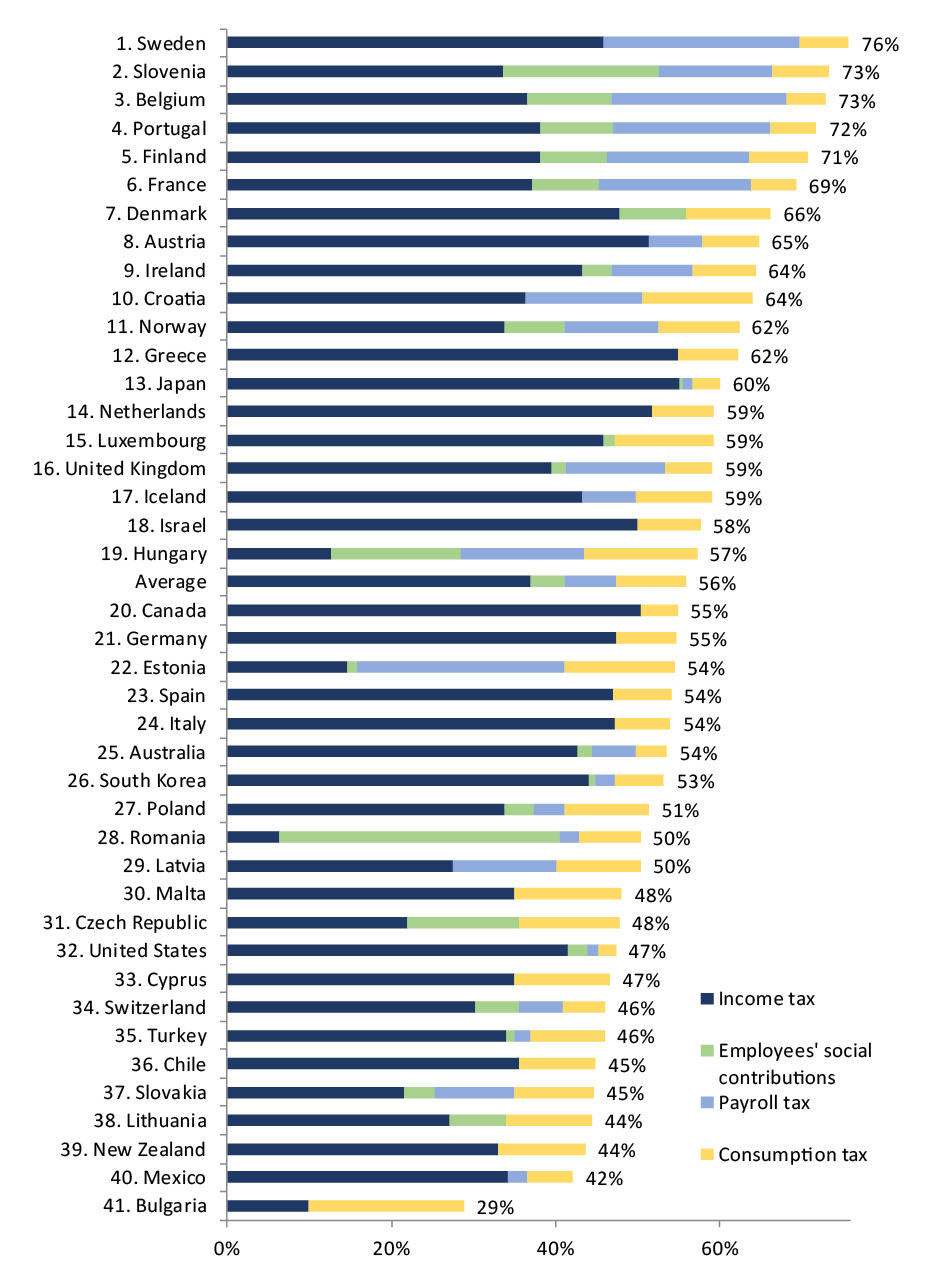

Taxing High Incomes A Comparison Of 41 Countries Tax Foundation

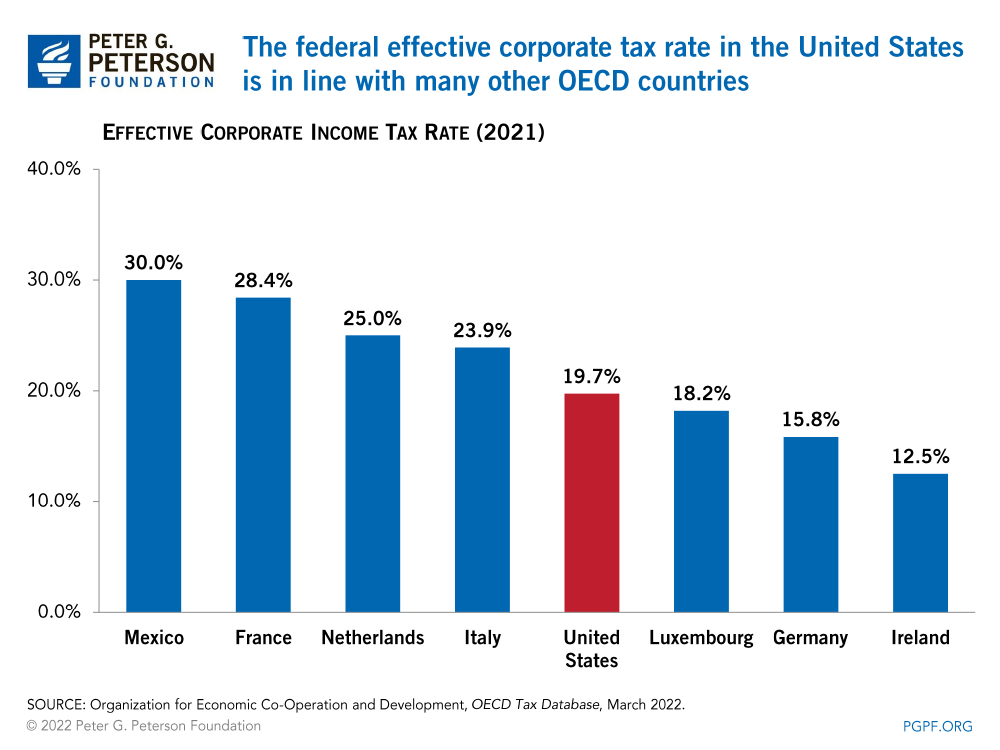

What Is The Difference Between The Statutory And Effective Tax Rate

Malaysia Personal Income Tax Rates 2022

Malaysia Personal Income Tax Rates 2022

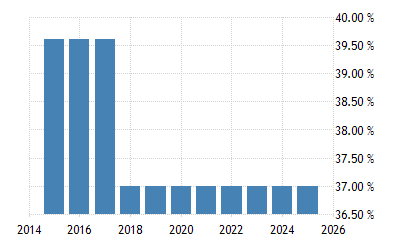

United States Personal Income Tax Rate 2022 Data 2023 Forecast

Malaysia Personal Income Tax Rates Table 2012 Tax Updates Budget Business News